Our Story

My grandfather loved to trade equities, he used to say, “there is always a good stock on sale!” He enjoyed researching all types of small and large cap companies. Newspapers were stacked in the corner next to his chair with company tickers highlighted. As his eye sight faded over the years, I would read articles to him about the companies he owned and so grew my interest in the capital markets.

For nearly twenty years, I have been managing money and have been privileged to work with some very bright minds and creative portfolio managers. I was trained at JP Morgan, one of the best Wall Street firms as a portfolio manager and have helped build several Registered Investment Advisors (RIA) into billion dollar firms.

At each stop along the way, I always felt like one critical component that was routinely overlooked was the quality experience for the client. Wall Street firms and private firms that are looking to be sold are all about the next quarters earnings. Maximizing the bank’s earnings from clients drives many of the companies decisions.

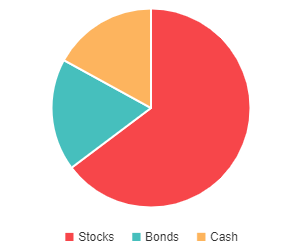

We launched Approach Capital as a means to deliver the investing approach we believe is right for each of our individual clients. Our focus is on active investment management, cash flow and estate planning and low cost, broad based asset solutions.

We look forward to working with you to understand your legacy goals and do our part to make them a reality!

Subscribe to our Newsletter.

Average Annual Inflation Rate In The United States Over The Past 90 Years

Average Annualized Total Return For The S&P 500 Over The Past 90 Years

Rule Of 72: For a rough estimate of how long it takes an investment to double, divide 72 by the annual rate of return